What happened in the floating homes real estate market in 2018? First and foremost, the floating homes community is looking more spruced up than ever to the outside world. The completion of the park along the Bridgeway frontage has undoubtedly enhanced our community’s curb appeal in the collective consciousness. Charles Van Damme dock is beautiful, and all WPH docks enjoy newly built dock houses. Add to this the fact that—aside from a small number of houseboats in Alameda, Richmond and San Francisco—this is the only sizeable floating homes community on San Francisco Bay, and you’ve got a winning combination of factors that support continued appreciation. There are very few residences on the Bay that offer such easy access to the watery open space right outside your back door, plus live interaction with the natural elements (read: weather, wildlife and fellow dock inhabitants).

Environmental regulations are such that no additional residential units will ever be developed on the Bay. When supply is restricted, price goes up. Combined with the fact that overall Marin Real Estate remains in high demand, the expectation for continued appreciation of floating homes is well placed. The word is out more than ever: floating homes are a good investment. But what’s happening with the overall housing market, given rising interest rates and a volatile stock market?

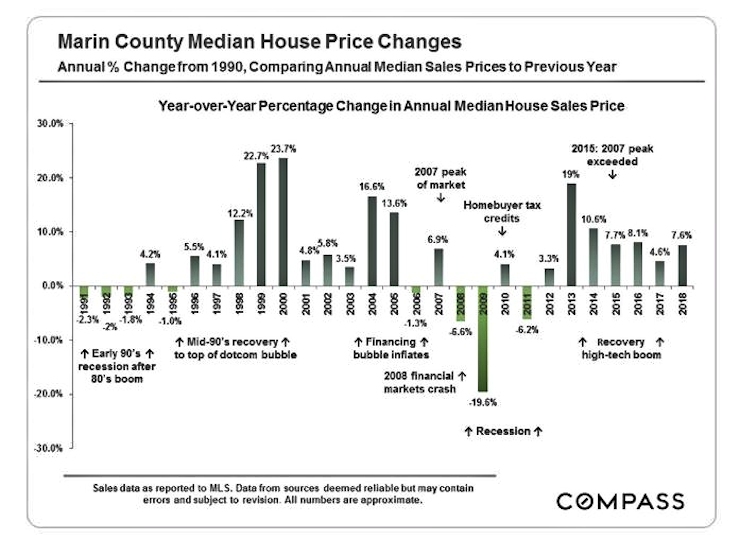

To be sure, rising interest rates directly affect real estate prices. The luxury portion of the market has already experienced a correction in many major cities. It’s too early to say how that market cooling will affect the middle and lower tiers of the real estate market. To understand the larger context, let’s look at the performance of the overall Marin real estate market last year. The chart below shows the trend of sales since 1990. The countywide price appreciation was 4.6% in 2017 and 7.6% in 2018.

Price appreciation in 2018 was greater than in 2017, but the chart below clearly shows that more homes stayed on the market longer without selling. This is often an indicator of a cooling market. It could be that sellers are anticipating ever higher values and consequently setting list prices higher than buyers are willing to pay. Or, it could be that interest rate hikes have already had a depressive effect on the market. Either way, more homes are sitting on the market longer and more listings are expiring. Many real estate economists and pundits are predicting a fairly flat market for 2019, with modest appreciation in values.

The Sausalito Floating Homes Market

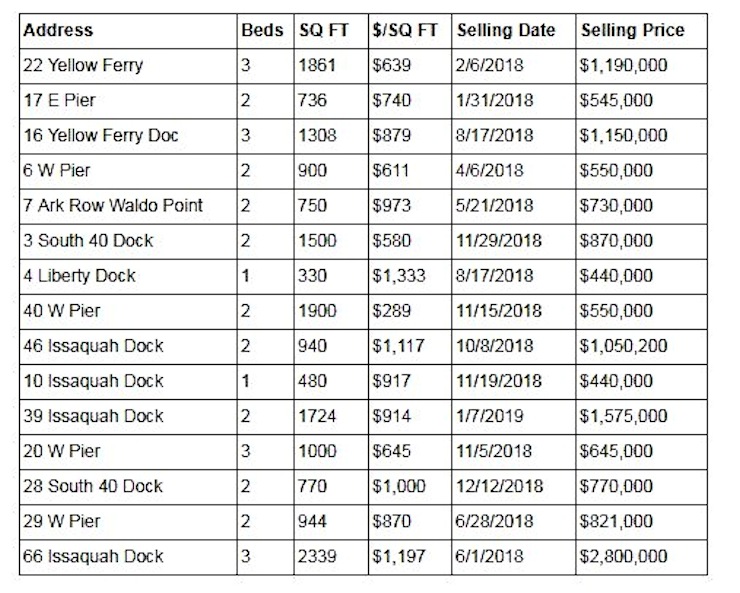

The table below summarizes all 2018 floating homes transactions reported on the MLS. As always, price per square foot is far from an absolute or perfect method of evaluation, but it is a worthwhile and useful indicator. There are many factors that affect sales price. To name a few: views, construction quality, condition, depth of water, total square footage, a floating dock on the lease agreement and the home’s ability to elicit an emotional connection with potential buyers.

Because smaller boats present an opportunity for a wider selection of buyers to enter the market, they can sometimes sell for very high $/Sq Ft, as did my listing at #4 Liberty Dock which sold at $1,333/Sq/Ft. Notably, 2018 also marked the sale of the highest-priced floating home in the community’s history: #66 Issaquah sold for $2.8 million at almost $1,200/Sq Ft. That home is in deep water, and tastefully updated with high quality finishes. It has a large permitted float and excellent views in multiple directions. 40 West Pier sold for less than $300/Sq Ft, which is reminiscent of prices 10 years ago. Between these poles, many homes sold in the $900/Sq Ft range (the average being about $850/Sq Ft). Boats with the best indoor-outdoor flow, expansive views and deep water are generally asking around $1,000/Sq Ft.

Summary of Sausalito Floating Home Market

The market remains solid. Boats that are move-in ready with high-quality finishes attract more buyers and fetch higher prices. As with real estate everywhere, determining the list price is part data science and part art. Limited supply, unique setting, access to San Francisco and the added attraction of a wonderful community continue to make owning a home in our community an excellent value proposition for new buyers.

Thinking about putting your Floating Home on the Market?

Paint, flowers, surfaces and decorating are always smart investments when marketing your home. It’s also worth planning when exactly you’ll list it for sale. Aside from the ebb and flow of the overall market place, it makes an enormous difference what month you put your home on market. The chart below examines data for the last 4 years and shows the ratio of list price to sales price. This graphic illustrates that the best time of year to sell your home is spring. After that, earlier in the year and summer are second best. Mid-winter wins the award for the worst time of year to sell. The moral of the story is that if you want to get top dollar for your home, it’s worth the effort to plan the time you’ll put it on the market and the steps you’ll take to prepare it.

If you are thinking of selling your floating home, I would be happy to meet with you and brainstorm on high-return investments you might make to ensure your home looks as good as it possibly to appeal to the most buyers and fetch the highest price.

If you are thinking of selling your floating home, I would be happy to meet with you and brainstorm on high-return investments you might make to ensure your home looks as good as it possibly to appeal to the most buyers and fetch the highest price.

Steve Sekhon is a founding member of Compass Marin, one of the most technologically-sophisticated, fastest-growing real estate companies in the United States. He has a master’s degree in urban planning, a California real estate brokers license and he has done tours of duty as an abstract painter and home investor and builder. He co-founded Gratitude24-7.com with his wife Jarl Forsman and TheVibe.me, a mindfulness meditation app with Jarl and co-founder Issaquah resident Jim Justice (that’s his real name).